oklahoma franchise tax instructions

When the economy goes into a recession corporate profits drop and franchise tax revenues also drop. Visit us at wwwtaxokgov to file your Franchise Tax Return Officer Listings Balance Sheets and Franchise Election Form Form 200-F.

Mine the amount of franchise tax due.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Oklahoma Tax Commission Post Office Box 26920 Oklahoma City OK. Paper returns without a 2-D barcode should be mailed to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800.

Oklahoma franchise tax instructions. But Oklahoma does have laws regulating the sale or offering of business opportunities under the Oklahoma Business Opportunity Sales Act Okla. To file your Annual Franchise Tax by Mail.

What is Oklahomas Franchise Tax. In Oklahoma the maximum amount of franchise tax a. Lets say you own a cute little diner in tulsa that earns 500000 each year.

Oklahoma is classified as a non-registration state because it has no laws requiring franchisors to register with the state before offering or selling their franchise. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Eligible entities are required to annually remit the franchise tax.

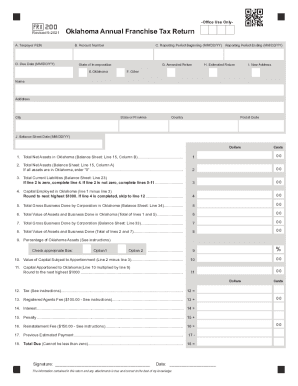

Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma City OK 73126-0930 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers. The maximum amount of franchise tax that a corporation may pay is 2000000. Determine the amount of franchise tax due.

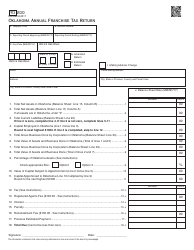

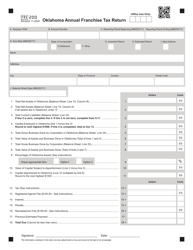

Instead they use Form 200-N Foreign Not-For-Profit Corporation Annual. Form 200 - Page 5. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

To make this election file Form 200-F. Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. The franchise tax is calculated at a rate of 125 per 1000 of capital employed in or apportioned to the businesss outpost in Oklahoma.

The franchise tax applies solely to corporations with capital of 201000 or more. 71 801 et seq. These elections must be made by July 1.

The report and tax will be delinquent if not paid on or before September 15. On the Oklahoma Tax Commission website go to the Business Forms page. Late payments of franchise tax 100 of the franchise tax liability must be paid with the extension.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Allocated or employed in Oklahoma. Payment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D.

Paper returns with a 2-D barcode should be mailed to the Oklahoma Tax Commission PO. Printing and scanning is no longer the best way to manage documents. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or employed in Oklahoma.

If you checked Box Eindicate the changes only below. Box 26930 Oklahoma City OK 73126-0930 Changes in Pre-Printed Information. Scroll down the page until you find Oklahoma Annual Franchise Tax Return Form 200 Note that foreign non-profit corporations dont use Form 200.

To make this election file Form 200-F. Oklahoma must file an annual franchise tax return and pay the franchise tax by july 1 of each year. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S.

The franchise tax is calculated at the rate of 125 for each 100000 of capital employed in or apportioned to Oklahoma. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax. California LLC - Annual LLC Franchise Tax.

Only those corporations with capital of 20100000 or more are required to remit the franchise tax. Mailing Instructions Please mail your completed return officer information and payment to Oklahoma Tax Commission Franchise Tax PO. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Oklahoma franchise return online e-sign them and quickly share them without jumping tabs. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return. Oklahomas Department of Commerce has a list of Business Licensing and Operating Requirements organized by industry.

Tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or. Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications.

To make this election file Form 200-F. If filing a consolidated franchise tax return for oklahoma the oklahoma franchise tax for each corporation is computed separately. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Time for Filing and Payment Information Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay. Texas Franchise Tax 2020.

A ten percent 10 penalty and one and one-fourth percent 125 interest. Handy tips for filling out Oklahoma form 200 online. The 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma form is 48 pages long and contains.

You form a new LLC and register with SOS on June 18 2020.

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

When Are Taxes Due In 2022 Forbes Advisor

Missouri Income Tax Rate And Brackets H R Block

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

How To Manage An Unexpected Tax Bill

Where S My Refund How To Track Your Tax Refund 2022 Money

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Get And Sign Income And Franchise Tax Forms And Instructions Oklahoma 2021 2022

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Franchise

Solved Oklahoma Nonresident Tax Return Ok 511 Nr Intuit Accountants Community

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

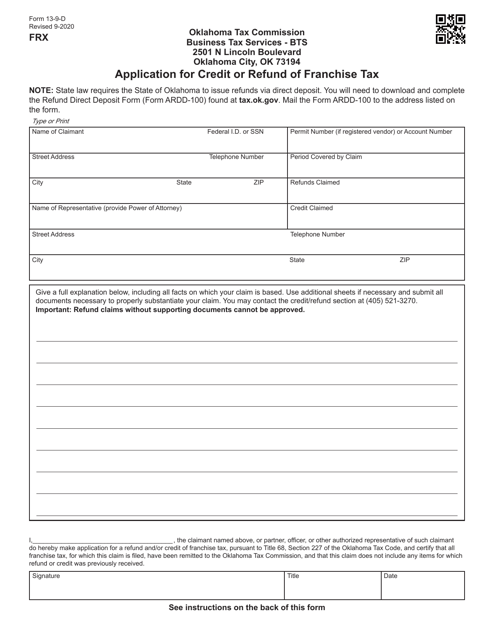

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)